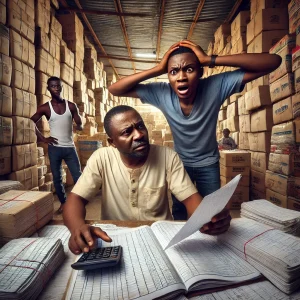

If you run a business in Nigeria, you’ve probably heard this from a customer: “I’ve paid, and I’ve been debited, but it’s not showing in your account!”

This sounds like a typical Nigerian small business drama, doesn’t it? Your customer swears they’ve made the payment. They even show you the debit alert from their bank. But when you check your account, the money is nowhere to be found. You hope it will come through in a few minutes… but minutes turn into hours, and hours turn into days, and the money still hasn’t entered your account.

The next step? You start calling your bank. The customer starts calling theirs. At the end of the day, someone’s going to have to spend precious time out of their day to visit the bank, fill out forms, and wait for the reversal process to start. It’s a whole drama—and if you’ve been in business long enough, you know it can be a recurring nightmare.

Why This Happens (And How to Avoid It)

So why does this happen? Well, it’s usually a case of delays in bank transfers, network issues, or even the occasional mix-up in payment channels. In the age of instant messaging and social media, it feels frustrating to deal with delays like this, especially when you’re trying to focus on running your business.

But here’s the thing—this doesn’t have to be your reality. You don’t have to deal with the constant back-and-forth with your customer or the endless phone calls to your bank. In fact, there’s a better way to handle payments that will save you time, money, and a whole lot of stress.

Automate Payments and Say Goodbye to the Drama

Now, you might be wondering—“How can I avoid this mess and make sure my customers are paying me on time, without all the drama?”

The answer is simple: automate your payments and use systems that verify payments in real-time. No more “I’ve been debited!” claims that leave you scratching your head.

Imagine a world where, as soon as a customer makes a payment, you know immediately if it has gone through or not. No more waiting hours or days to confirm. No more chasing after your bank to figure out what happened. Everything is confirmed in real-time, so you can focus on what really matters—running your business and serving your customers.

Not only will this save you time, but it will also improve the trust between you and your customers. They won’t have to keep calling you about payment status, and you won’t be left stressing about whether or not the money has hit your account.

So, How Do You Make This Happen?

The key to smoother, more efficient payments is investing in technology that allows for instant verification. By implementing systems that keep track of payments automatically, you’ll reduce the stress of chasing payments, answering endless questions, and dealing with the frustration of unexplained delays.

If you haven’t already, consider exploring tools and systems that can streamline your payment process. When you do, you’ll be able to say goodbye to those long phone calls, endless customer complaints, and the dreaded bank visit altogether.